Commodities Beyond Oil: Macro Trends Shaping Agricultural and Industrial Metals

When most investors think about commodities, oil tends to dominate the conversation. Gasoline prices are visible, politically sensitive, and closely watched. Yet outside of energy, agricultural commodities and industrial metals have been shaped by their own powerful macro forces. In recent years, geopolitics, weather volatility, and structural demand shifts have reshaped supply and pricing dynamics in ways that deserve closer attention.¹

Agriculture: Abundance Meets Uncertainty

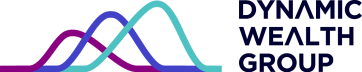

Agricultural markets in 2025 illustrated how quickly balance can give way to disruption. Global grain harvests were unusually strong, with wheat, corn, and soybean production surging across major growing regions. The result was swollen inventories and downward pressure on staple crop prices.¹ What appeared to be a supply-driven story soon collided with geopolitics.

Trade tensions between the United States and China disrupted soybean exports for much of the year, forcing U.S. producers to rely more heavily on alternative buyers.¹ Even after trade flows resumed, China’s dependence on U.S. supply had diminished due to record Brazilian output. Agricultural markets were reminded that demand can evaporate just as quickly as it forms.

Weather added another layer of complexity. Improved growing conditions in North America helped ease prior drought concerns.² At the same time, El Niño-driven dryness hurt coffee and sugar production in parts of Asia and Latin America, pushing prices sharply higher.² Livestock markets felt parallel pressures. A prolonged period of dry conditions and elevated feed costs reduced U.S. cattle inventories to historic lows, driving beef prices higher by late 2025.¹ Agriculture remains a market where localized abundance often coexists with global scarcity.

Industrial Metals: Policy, Supply, and Structural Demand

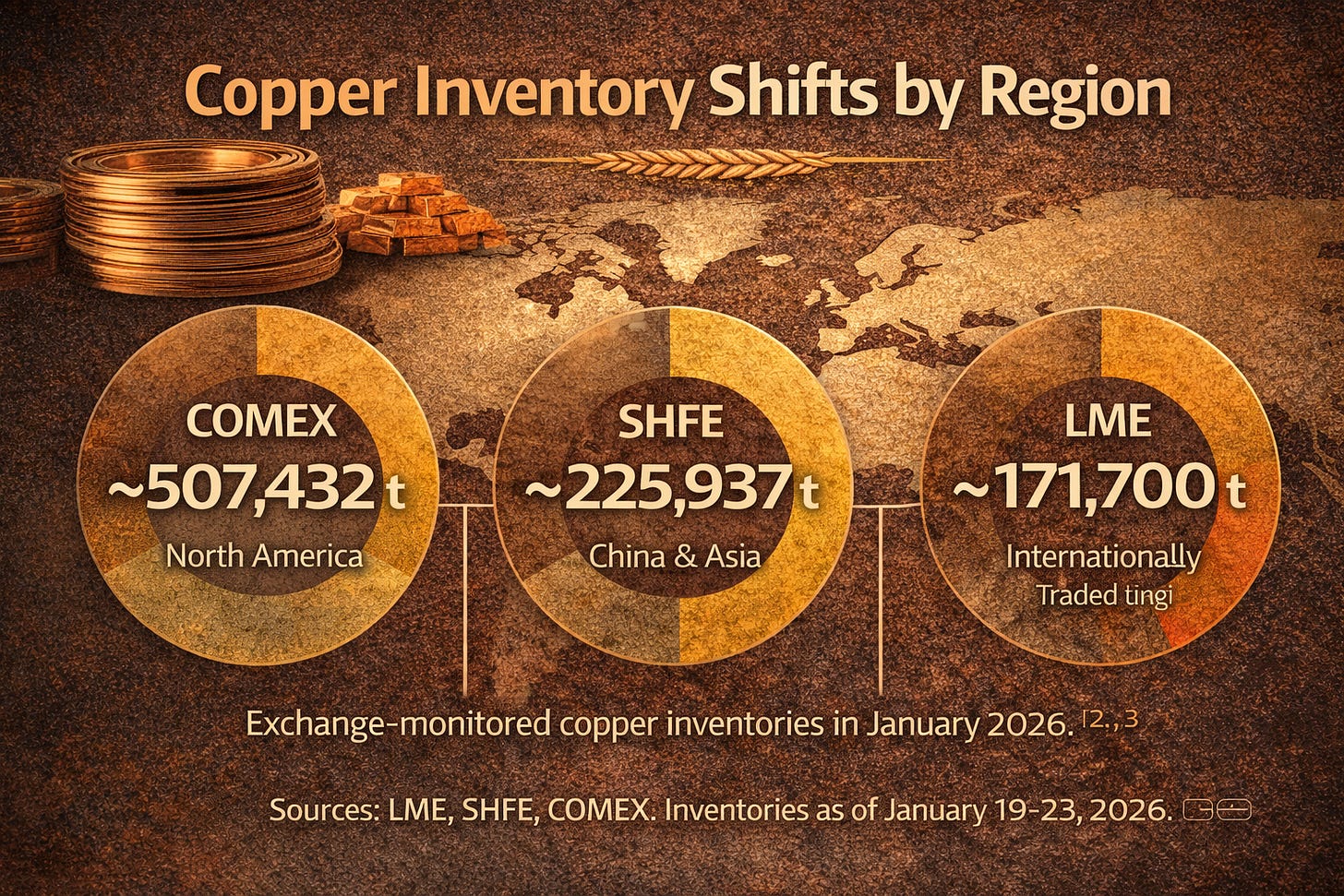

Industrial metals told a very different story. Despite uneven global manufacturing activity, prices remained firm due to supply constraints and policy distortions.³ Copper stood at the center of this dynamic. Stockpiling ahead of potential U.S. tariffs shifted inventory into American warehouses, tightening availability elsewhere and pushing prices toward record territory.³ The episode underscored how trade policy alone can create regional shortages.

Aluminum faced similar stress. Production growth has been capped by Chinese capacity limits, while sanctions and tariffs have complicated sourcing for Western buyers.⁴ U.S. aluminum premiums climbed sharply, reflecting constrained local supply rather than booming demand.³ Even smaller markets such as tin experienced outsized price moves as geopolitical concentration collided with rising technology use.³

Beyond near-term disruptions, a longer-term theme is taking shape. The global transition toward electrification is steadily increasing demand for metals such as copper, nickel, and aluminum. Renewable energy installations and electric vehicles require significantly more raw materials than traditional systems.⁵ Over time, this structural demand may strain existing supply, particularly if new mining investment fails to keep pace.

Why It Matters for Investors

For investors, the takeaway is straightforward. Commodities are not a monolith, and oil is only one piece of the puzzle. Agricultural markets remain highly sensitive to weather and trade policy, while industrial metals are increasingly shaped by geopolitics and energy transition dynamics. These forces can drive returns independently of equity or bond markets, offering diversification potential but also meaningful volatility.²

Years of stable inflation and reliable supply chains encouraged many portfolios to underweight commodities. That backdrop is changing. As global trade realigns and physical inputs regain strategic importance, agriculture and industrial metals deserve renewed attention. Supply and demand still rule these markets. What has changed is how fragile that balance has become.

Footnotes

Karen Braun, “Five Charts That Defined Agricultural Markets in 2025,” Reuters, December 18, 2025.

Robert Minter, “Commodities: The Year That Was, the Year That Could Be,” Aberdeen Insights, December 16, 2024.

Andy Home, “Disruption and Dislocation: LME Metals’ Year in Seven Charts,” Reuters, December 23, 2025.

Andy Home, “Aluminium Is Base Metals Analysts’ Bull Pick for 2025,” Reuters, February 5, 2025.

Giann Liguid, “S&P Global: Copper Becoming One of the World’s Most Strategic Commodities,” Investing News Network, January 22, 2026.

This material presented by Dynamic Wealth Group (“DWG”) is for informational purposes only and is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy, or investment product. Facts presented have been obtained from sources believed to be reliable, however DWG cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source. DWG does not provide legal or tax advice, and nothing contained in these materials should be taken as legal or tax advice.