Is the Global Economy Decoupling From U.S.-Led Monetary Policy? — Assessing Divergence in Growth Trends Between Major Economies

For much of the post-crisis era, global monetary policy moved in near lockstep with the U.S. Federal Reserve. When the Fed tightened, others followed. When it eased, the rest of the world usually complied. That assumption began to break down in early 2025. The U.S. economy continued to expand at a healthy clip, supported by firm consumer demand and resilient labor markets. Inflation remained sticky enough to justify a restrictive stance, leaving the Fed unwilling to signal near-term rate cuts.

Outside the United States, conditions diverged sharply. Growth slowed across Europe, Canada, and parts of Asia, pushing foreign central banks toward accommodation even as the Fed stood still. The European Central Bank, Bank of England, and Bank of Canada each moved to cut rates despite explicit signals that Washington was not prepared to do the same.¹ This divergence was not a policy experiment. It was a response to materially weaker domestic conditions that made adherence to Fed leadership impractical.

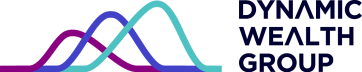

Economies on Separate Tracks

The growing policy split reflected widening differences in economic momentum. Europe hovered near stagnation, weighed down by high energy costs, fragile confidence, and trade uncertainty. Growth expectations for the euro area deteriorated further as new tariff risks emerged, reinforcing concerns about recession rather than overheating.² Germany’s export-heavy economy felt these pressures acutely, prompting policymakers to shift toward easing as industrial output and external demand softened.²

China’s trajectory differed even more sharply. A prolonged property downturn, weak consumer sentiment, and deflationary pressures forced Beijing to prioritize stimulus well ahead of any Fed pivot. Chinese authorities cut key interest rates to support domestic demand, underscoring how far its policy priorities had drifted from those of the United States.³ Inflation in China periodically turned negative, reinforcing the case for early easing rather than restraint.

Emerging markets also found themselves on a different cycle. Many had tightened aggressively earlier in the inflation surge and entered 2025 with price pressures largely under control. That credibility gave policymakers latitude to cut rates sooner, aiming to revive growth without reigniting inflation. By the end of 2025, a majority of the world’s most actively traded currencies were backed by central banks that had already eased policy, marking the largest global rate-cut cycle since 2009.⁴ Analysts noted that emerging economies were able to move first precisely because inflation had been brought under control earlier than in advanced markets.⁴

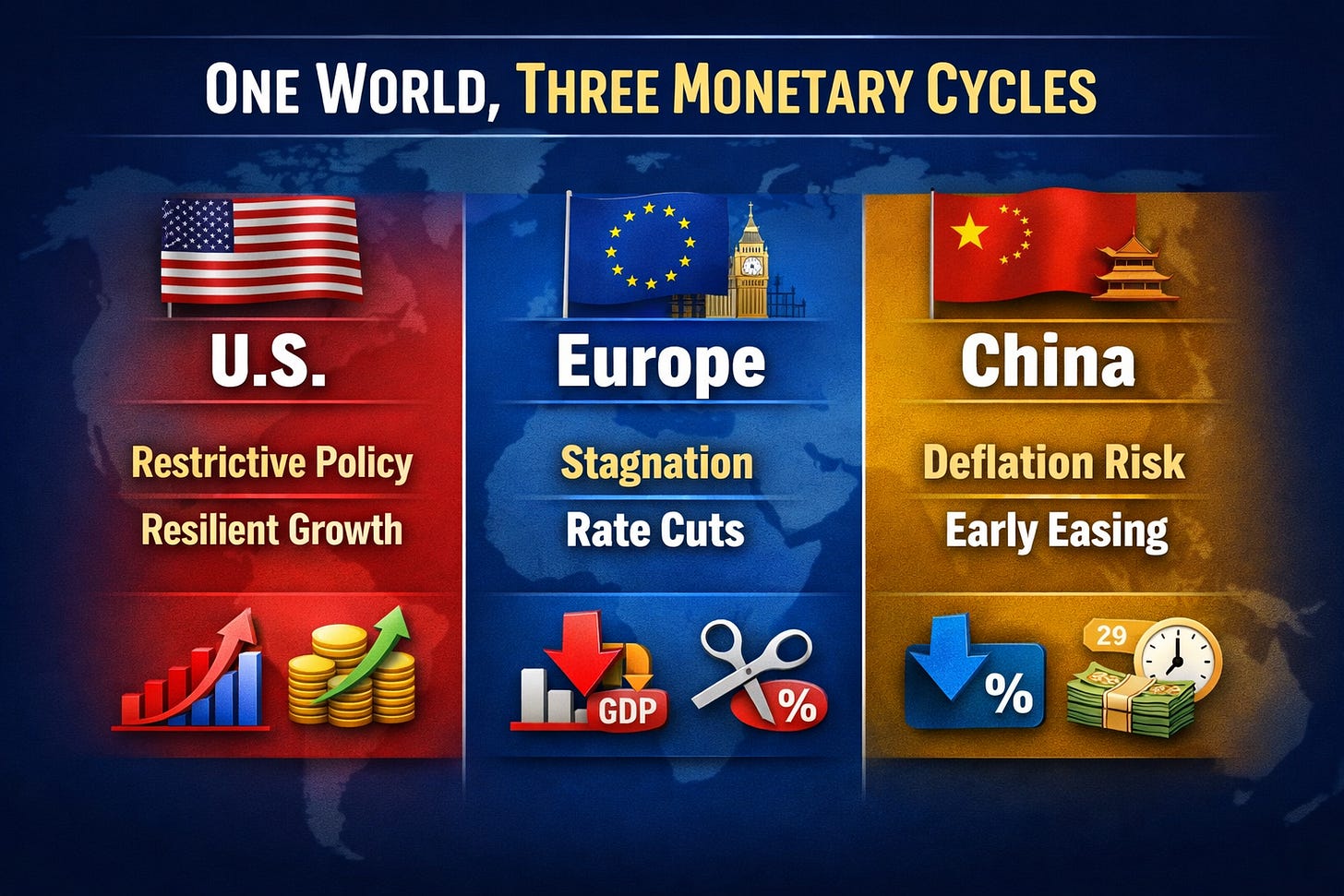

Investing in a Decoupled Global Cycle

For investors, this shift toward a multi-speed global economy reshapes both opportunity and risk. Divergent growth and policy paths reduce the likelihood that markets will rise and fall together. Regions benefiting from easier financial conditions may outperform even if U.S. assets struggle under tighter policy. Lower rates abroad have helped stabilize credit conditions and encouraged selective recoveries, particularly in parts of Asia and Europe.

Currency dynamics have become more influential as well. Higher relative U.S. rates strengthened the dollar, which in turn improved the competitiveness of foreign exporters selling into the U.S. market. That currency effect helped offset some of the drag from trade frictions and supported earnings in export-oriented economies.¹ In a less synchronized world, policy decisions in Frankfurt or Beijing can matter as much as those in Washington when it comes to shaping capital flows.

The risks are equally important. Wider interest-rate differentials can amplify currency volatility and expose balance-sheet vulnerabilities, particularly where debt is dollar-denominated. Investors must also contend with multiple policy regimes that can change direction abruptly if inflation resurfaces or growth falters. The simplicity of a single, Fed-led global cycle has given way to a more complex landscape.

The global economy is not fully detached from U.S. monetary policy, but it is no longer governed by it alone. Trade, finance, and capital markets remain deeply interconnected. What has changed is the assumption that the Fed dictates the timing and direction of every cycle. For investors, that reality places a premium on global diversification, currency awareness, and close attention to regional fundamentals. The era of automatic synchronization appears to be fading, replaced by a more fragmented but nuanced global monetary order.

Footnotes

Balazs Koranyi and John Revill, “Leaving Fed Behind, Top Central Banks Have Room to Ease,” Reuters, February 7, 2025.

“IMF Cuts Euro Zone Growth Forecast Amid Tariff Uncertainty,” Reuters, April 22, 2025.

“China Cuts Several Major Interest Rates to Support Fragile Economy,” Reuters, July 22, 2024.

Karin Strohecker and Sumanta Sen, “Major Central Banks Deliver Biggest Easing Push in Over a Decade in 2025,” Reuters, December 23, 2025.

This material presented by Dynamic Wealth Group (“DWG”) is for informational purposes only and is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy, or investment product. Facts presented have been obtained from sources believed to be reliable, however DWG cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source. DWG does not provide legal or tax advice, and nothing contained in these materials should be taken as legal or tax advice.