The Fed Won’t Admit It: Why Policymakers May Accept Higher Inflation

Prices are creeping up, but the Fed is patting itself on the back. In September 2025, Fed officials cut interest rates even though inflation was still coming in above 2%. Members voted to reduce the funds rate by 25 basis points, noting that risks to jobs had increased while those posed by inflation were “either diminished or not increased.”¹ The official statement from the Fed itself still acknowledges that inflation “remains somewhat elevated” and even “has moved up” as they were introducing ease.²

Chair Powell said it bluntly at the news conference: After roaring up in 2021, inflation has cooled off a bit but “remains somewhat elevated relative to our 2 percent longer-run goal.”³ Inflation is running high — but coming down. Recent actions by the Fed represent a balancing act. Policymakers are no longer as jumpy about 3% inflation as they were a year ago. However, many Fed officials see the risk of a cooling labor market as more salient than a dab of excess inflation. Powell and others stressed that policy is malleable and data-dependent, explaining that they are cutting rates now in response to softening in the job market (and price spikes driven by tariffs that should dissipate). The clear message: the Fed isn’t dropping its 2% target, but it will be tolerant of a modest overshoot if that’s what it takes to avoid a recession.

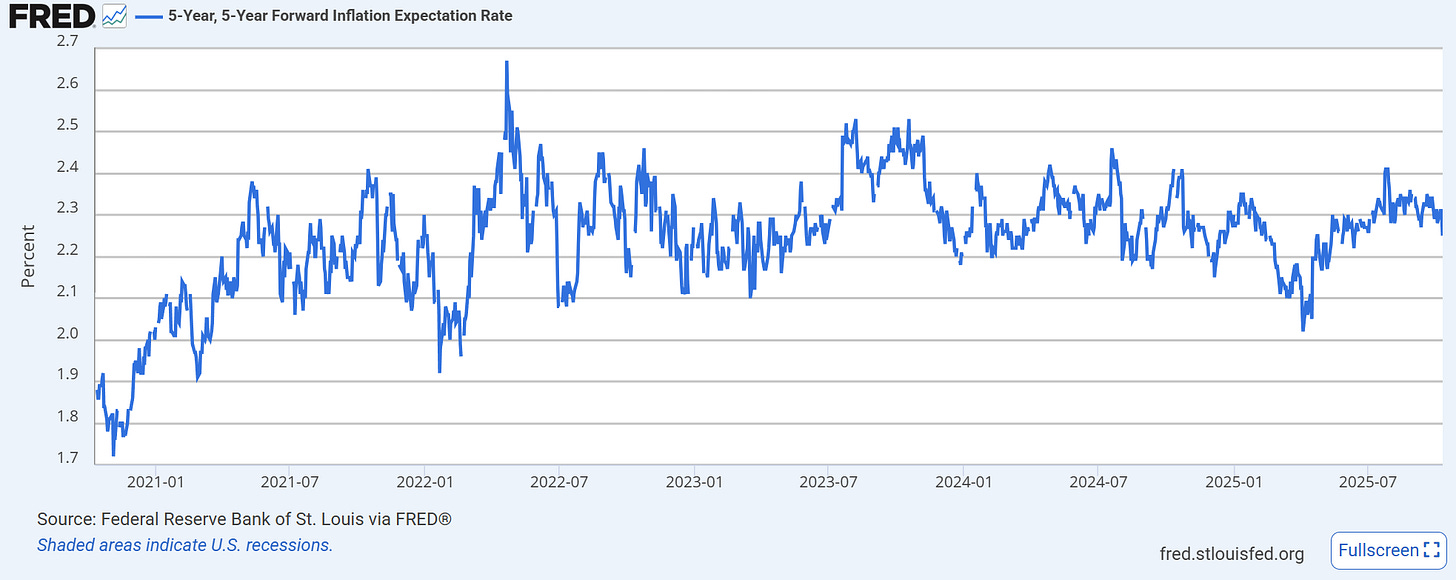

How did we get here? The Fed’s new strategy, announced at Jackson Hole in August 2025, formally abandoned the commitment to drive inflation above 2% to make up for past shortfalls.⁴ That sounds like a hard line, on paper. But look at the context: It was a period of high real interest rates, slowing global demand and tariffs that had temporarily buoyed headline inflation. Policy makers know very well that aggressive rate hikes would potentially result in further layoffs. Even those warning that inflation has been “too high for a long time” like Atlanta Fed President Raphael Bostic concede the acceleration will slow. At the same time, New York Fed President John Williams has been on record for years saying that the Fed would have to “deliberately overshoot” its 2% aim to make up for past undershoots.⁵ In private, some Fed officials have let on that they’re okay with letting inflation run at around 2.5–3% for a while, provided expectations stay anchored.

The implication for investors is that inflation may remain above 2% longer than the headline target value implies. This is not tantamount to runaway inflation — it simply means being prepared for moderately higher prices. For one thing, real yields are probably less than headline rates so, if you’re locking into long-term bonds, that seems riskier. Equities and real assets do better in mild inflation, so it may make sense to keep some exposure to commodity sectors, energy or stocks of companies with pricing power. Strategies that shine in diverse regimes—think global macro or multi-asset funds—may also help smooth returns. These approaches often profit by shifting into inflation hedges (gold, inflation-linked bonds, or commodity futures) when price pressures persist, and flipping to more defensive assets if the economy really turns sour.

Altogether, the Fed’s rhetoric still preaches 2 percent price stability, but its deeds whisper tolerance for a bit more than that. The lesson: don’t bet on a rapid return to the days of ultra-low inflation. Investors should prepare for several quarters of above-target inflation. That means tweaking portfolios for a slightly hotter economy while reducing the chances that price pressures linger. In today’s policy environment, it’s worth remembering that jobs and prices are pulling in different directions — and the Fed has demonstrated that it will err on the side of giving a little more help with job growth, even if it means inflation stays a touch higher for now.

Footnotes

Board of Governors of the Federal Reserve System, Minutes of the Federal Open Market Committee, September 16–17, 2025, https://www.federalreserve.gov/monetarypolicy/fomcminutes20250917.htm.

Board of Governors of the Federal Reserve System, Federal Reserve Issues FOMC Statement, September 17, 2025, https://www.federalreserve.gov/newsevents/pressreleases/monetary20250917a.htm.

Jerome H. Powell, Transcript of Chair Powell’s Press Conference, September 17, 2025, https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20250917.pdf.

Michael S. Derby, “Fed’s Powell Says New Framework Back on Traditional Footing,” Reuters, August 22, 2025, https://www.reuters.com/markets/us/feds-powell-says-new-framework-back-traditional-footing-2025-08-22/.

Jonnelle Marte, “NY Fed’s Williams Says Will Need to Overshoot 2% Inflation Target,” Reuters, September 29, 2020, https://www.reuters.com/article/usa-fed-williams-idUSL2N2GO1UE.

This material presented by Dynamic Wealth Group (“DWG”) is for informational purposes only and is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy, or investment product. Facts presented have been obtained from sources believed to be reliable, however DWG cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source. DWG does not provide legal or tax advice, and nothing contained in these materials should be taken as legal or tax advice.